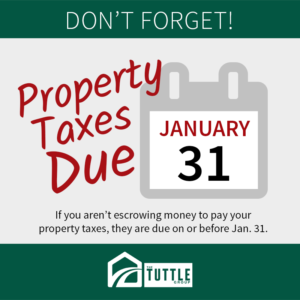

Don’t Forget: Property Taxes Due Jan. 31

Either way, property taxes are delinquent if not paid on or before January 31. In fact, Texas state law requires that penalty and interest be charged on taxes paid after January 31.

Paying Property Taxes

Property tax payments are commonly made by mail and MUST BE POSTMARKED by the United States Postal Service on or before January 31. On February 1, penalty and interest begin to accrue. When paying your taxes by check, don’t forget to write your Property Account number on the check.