Buying Your First Home in Dallas: What You Need to Know

Buying your first home is an exciting milestone, but the process can feel overwhelming without the right guidance. Dallas Home Loans come in various types, each suited to different financial situations. Understanding your mortgage options ensures a smoother process and helps secure the best loan for your needs.

This guide walks you through the essential aspects of home loans for first-time homebuyers in Dallas, including loan types, eligibility requirements, and application steps. Plus, we’ll show you how The Tuttle Group can assist in achieving your dream of homeownership.

Understanding Dallas Home Loans

The right mortgage can impact your monthly payments, interest rates, and financial stability. As a first-time homebuyer, choosing a loan type that aligns with your credit score, income, and long-term goals is crucial. We offer a variety of home loan programs tailored to different needs.

Best Loan Types for First-Time Home Buyers in Dallas

Conventional Loans

These are standard mortgage loans not backed by the government. Best for buyers with good credit (620+ FICO score) and a 5–20% down payment. They offer competitive interest rates and flexible loan terms.

Learn more: Conventional Loan Requirements

FHA Loans

Federal Housing Administration (FHA) loans cater to buyers with lower credit scores. With a minimum credit score of 580 and a down payment as low as 3.5%, FHA loans make homeownership accessible for many first-time buyers.

Learn more: FHA Loan Requirements

VA Loans

Designed for veterans, active-duty military personnel, and eligible spouses, VA loans require no down payment and no private mortgage insurance (PMI). They offer competitive rates and are one of the best loan options for military families.

Learn more: VA Loan Requirements

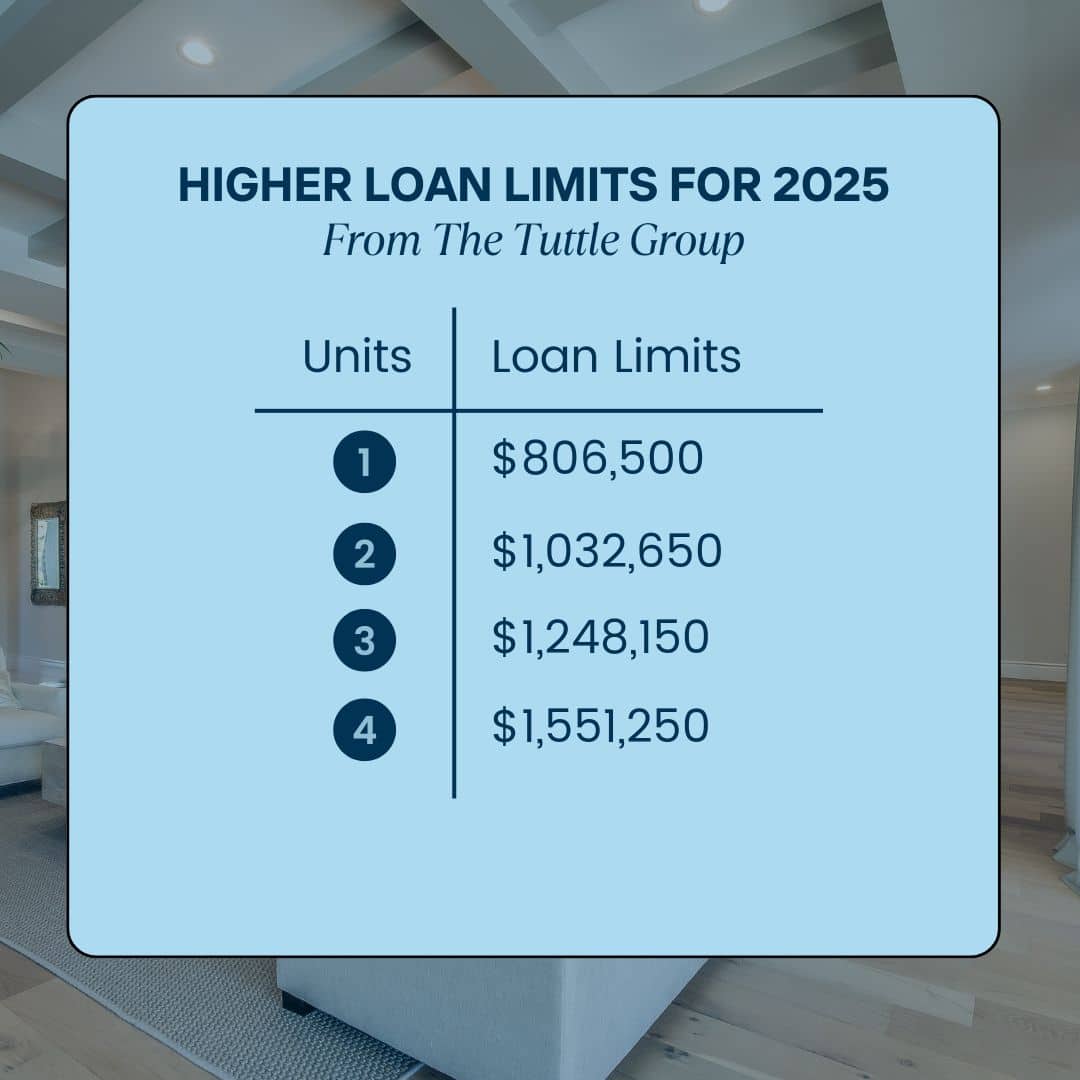

Jumbo Loans

For buyers looking at properties above conventional loan limits (typically $806,500 in Dallas County), jumbo loans are necessary. These require higher credit scores (680+) and larger down payments (10–20%).

Learn more: Jumbo Loan Requirements

Loan Comparison Table

| Loan Type | Max Loan Amount | Min Credit Score | Down Payment | Best For |

| Conventional | $806,500 | 620 | 5-20% | Buyers with good credit and savings |

| FHA | Up to $571,550 in Texas | 580 | 3.5% | Buyers with lower credit scores |

| VA | $806,500* | 580 | 0% | Veterans, military, and eligible spouses |

| Jumbo | $806,500+ (minimum loan) | 680 | 10-20% | High-income buyers purchasing expensive homes |

Finding a Perfect Home: Top Realtors in Dallas

Navigating the home-buying process is easier with a knowledgeable realtor. The Tuttle Group collaborates with over 250 top realtors in Dallas, ensuring you work with professionals who understand the market.

Benefits of Working with an Experienced Realtor:

- Expertise in market trends and property values

- Strong negotiation skills to secure the best deal

- Guidance in navigating complex paperwork and contracts

- Access to exclusive property listings

Choosing the right Dallas Home Loan is only part of the process—having an expert by your side can make all the difference.

Find trusted realtors: Top Realtors in Dallas

Getting a Home Loan in Dallas: Tips and Best Practices

Step-by-Step Guide to Securing a Mortgage

1. Assess Your Financial Readiness

Check your credit score, debt-to-income ratio, and overall budget. Lenders use these factors to determine your mortgage eligibility.

2. Get Pre-Approved

A pre-approval letter shows sellers that you’re financially ready to buy. The Tuttle Group offers a fast and efficient pre-approval process.

3. Choose the Right Loan

Refer to the Dallas home loan types above and select the best fit based on your financial profile.

4. Finalize Your Mortgage and Close

Once you’ve found a home, The Tuttle Group ensures a smooth closing process, handling paperwork and final loan approvals.

Actionable Tips for Improving Mortgage Eligibility in Dallas

Improve Your Credit Score

- Obtain a free credit report and check for errors.

- Keep credit card balances below 30% of your credit limit.

- Consider credit counseling if needed.

Check your credit score: FICO Credit Scores

Increase Your Income

- Explore job opportunities in your field.

- Take on freelance work or part-time employment.

Reduce Your Debt-to-Income Ratio (DTI)

- Prioritize paying off credit cards and high-interest loans.

- Consider debt consolidation for better interest rates.

Save for a Down Payment

- Set up automatic transfers to a savings account.

- Research down payment assistance programs.

Improve Your Employment History

- Maintain consistent employment for at least two years.

- Keep accurate records of past job history.

Address Outstanding Issues

- Work with a professional to resolve tax liens or judgments.

- Dispute and correct inaccurate information on your credit report.

Why Choose The Tuttle Group?

Finding the best loan types for first-time homebuyers requires expert guidance. The Tuttle Group simplifies the mortgage process by offering:

- Personalized loan guidance and expert recommendations

- Strong partnerships with top Dallas realtors

- Quick and efficient pre-approval process

- Competitive interest rates and flexible loan options

With a customer-first approach, The Tuttle Group ensures first-time buyers secure the best financing option tailored to their needs.